Money Mindset: Unlocking Your Financial Potential

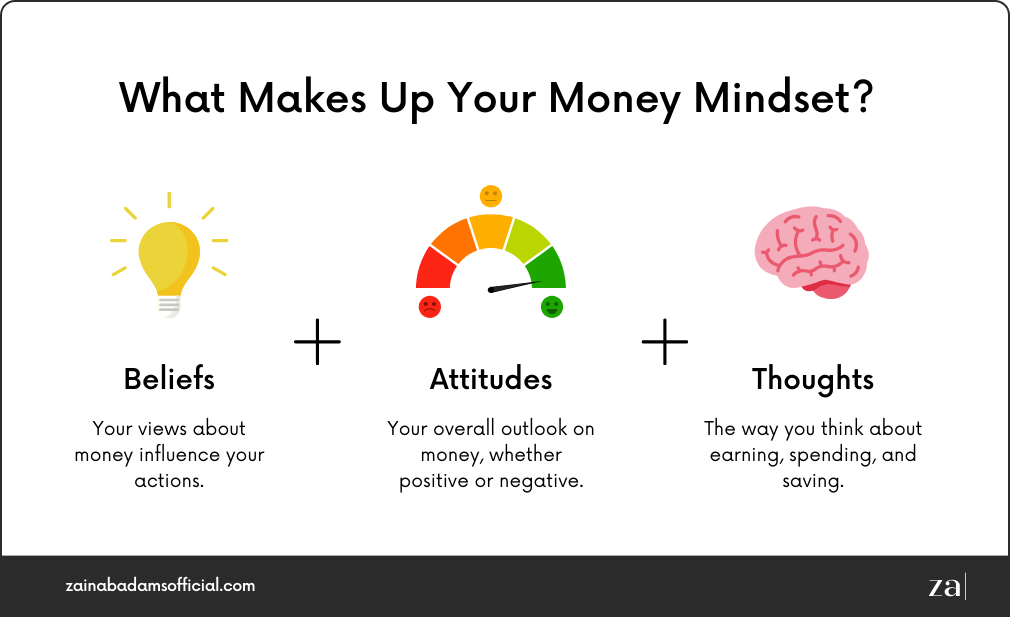

What is a Money Mindset?

A money mindset is the set of beliefs, attitudes, and feelings you hold about money. It determines how you think about earning, saving, spending, investing, and managing money in your life. Your money mindset influences your financial decisions on a daily basis and shapes your long-term wealth-building potential.

Some people have a scarcity mindset — believing money is hard to come by, always fearing a lack of resources. Others have an abundance mindset — viewing money as a tool for growth, believing opportunities for wealth are everywhere.

Your money mindset is not fixed. It is shaped by your upbringing, life experiences, societal influences, and the people around you. With effort, awareness, and education, anyone can shift their mindset to align with their financial goals.

Why is a Positive Money Mindset Important?

Your money mindset influences your financial behavior, which directly affects your financial outcomes. Here’s why it matters:

1. Influences Financial Choices

If you believe that wealth is only for the lucky or unethical, you may avoid investing or high-earning opportunities, limiting your financial growth. On the other hand, a positive money mindset helps you seek out and take advantage of those opportunities.

2. Builds Financial Confidence

When you develop a healthy money mindset, you feel more confident in your ability to manage money, make decisions, and plan for the future.

3. Reduces Financial Stress

A strong money mindset helps reduce anxiety and fear around money. You stop viewing money as a source of constant struggle and start seeing it as a manageable part of life.

4. Supports Long-Term Goals

Your beliefs about money will either push you forward or hold you back from achieving your dreams. With the right mindset, you’re more likely to stick to budgets, invest wisely, and build wealth sustainably.

How is Money Mindset Formed?

How is Money Mindset Formed?

Your money mindset starts forming in childhood. Here are the key influences:

1. Parental Influence

What your parents said or did about money plays a huge role. For example, if your parents argued about money, you might associate money with stress. If they taught you to save and invest, you might carry those habits into adulthood.

2. Cultural and Social Messages

Society often sends strong messages about wealth. Media can glorify materialism or paint the rich in a negative light. Cultural beliefs can shape whether wealth is seen as something to strive for or to avoid.

3. Personal Experiences

Did you grow up in scarcity or abundance? Were there times you didn’t have enough? Or did you see money work well for others around you? These experiences become internalized and inform your money beliefs.

4. Education and Financial Literacy

The more you learn about money, the more confident and empowered you become. A lack of financial education can lead to fear or avoidance of money matters.

Types of Money Mindsets

Understanding where you fall can help you reshape your financial beliefs.

1. Scarcity Mindset

Belief: “There’s never enough money.”

Behavior: Fear of spending, hoarding money, avoiding financial risks.

Outcome: Stuck in survival mode, limited growth.

2. Abundance Mindset

Belief: “There’s plenty of money and opportunity.”

Behavior: Strategic spending, investing, sharing wealth.

Outcome: Financial growth, generosity, opportunity seeking.

3. Avoidant Mindset

Belief: “Money is too complicated.”

Behavior: Ignoring bills, not budgeting, avoiding financial planning.

Outcome: Debt accumulation, financial instability.

4. Spender Mindset

Belief: “Money is for enjoyment.”

Behavior: Impulse spending, lifestyle inflation.

Outcome: Temporary pleasure, long-term financial issues.

5. Saver/Investor Mindset

Belief: “Money should work for me.”

Behavior: Budgeting, investing, planning for the future.

Outcome: Long-term wealth and security.

How to Identify Your Current Money Mindset

Ask yourself:

What do I believe about money?

Do I think money is good or bad?

Am I comfortable talking about finances?

How do I react when I get or lose money?

Do I feel in control of my financial life?

Reflect on your past and observe patterns in your money habits. Awareness is the first step toward change.

Shifting to a Positive Money Mindset

Changing your money mindset takes time and consistency. Here are practical steps to help shift from scarcity to abundance:

1. Challenge Limiting Beliefs

Notice beliefs like:

“I’ll never be rich.”

“I’m just bad with money.”

“You have to work extremely hard to earn money.”

Replace them with empowering beliefs:

“I can learn to manage and grow my money.”

“Opportunities for wealth are available to me.”

2. Educate Yourself

Financial literacy is key. Learn about budgeting, investing, saving, and debt management. Read books, listen to podcasts, or take courses. The more you know, the more confident you’ll feel.

3. Set Clear Financial Goals

Whether it’s buying a home, retiring early, or starting a business, set goals that excite you. A clear purpose drives motivation and shifts your thinking from survival to growth.

4. Practice Gratitude and Abundance

Focus on what you have rather than what you lack. Keep a gratitude journal. A mindset of abundance attracts more opportunities and reduces anxiety about money.

5. Surround Yourself with Positive Influences

Spend time with people who have a healthy relationship with money. Join financial communities, follow money mentors, or get a coach. Conversations around wealth can help you reframe your beliefs.

6. Take Action

Even small actions — like saving ₹500 a week or reading one finance article daily — reinforce a positive mindset. Consistent action builds momentum.

Building Wealth with the Right Mindset

Having the right mindset is the foundation. Combine it with strategy, discipline, and patience, and you’re on your way to financial freedom.

1. Budget Wisely

A budget gives you control. It’s not about restriction — it’s about awareness. Allocate money for needs, savings, investments, and enjoyment.

2. Save with Intention

Save a portion of every income you receive. Build an emergency fund first, then save for your long-term goals.

3. Invest for the Future

Don’t let fear stop you from investing. Learn about stocks, mutual funds, or real estate. Even small investments grow over time thanks to compound interest.

4. Avoid Debt Traps

Not all debt is bad, but unplanned debt can ruin your financial health. Borrow for appreciating assets, not lifestyle expenses.

5. Diversify Your Income

Explore additional income streams. Side businesses, freelancing, or investments can increase your financial security.

Maintaining a Positive Money Mindset

It’s not a one-time fix. Life changes, and so does your financial journey. Here’s how to stay on track:

Review your beliefs regularly. Keep replacing limiting thoughts with empowering ones.

Celebrate progress. Reward yourself for financial wins, big or small.

Stay informed. Keep learning and adapting to new opportunities.

Stay patient. Wealth building takes time. Trust the process.

Conclusion

Your money mindset is the invisible force that drives your financial behavior. A negative mindset can keep you stuck in patterns of fear, avoidance, or scarcity. A positive mindset opens the door to opportunity, growth, and financial peace.

By understanding your money story, challenging limiting beliefs, and taking consistent action, you can create a healthier relationship with money — one that supports your dreams and values.

https://www.facebook.com/nimblefoundation1

https://www.linkedin.com/in/satish-kakri-executive-coach-17224417/

Thanks for Reading.